Working in Belgium and entitlement to cash benefits

Cash benefits in Belgium and the conditions for obtaining them. Are you entitled to them?

Sickness benefits

Sickness benefits serve to replace income when an employee is unable to work because of illness. During the first 30 days of sick leave, the employee is still entitled to a salary, the amount of which depends on the type of occupation of the employee and the duration of the incapacity for work:

- officials - 100% of the salary for the first 30 days of sick leave,

- manual workers:

- 100% of the salary for the first 7 days of sick leave,

- 85,88% of salary from 8 to 14 days of sick leave,

- 25,88% of the wage from the 15th to the 30th day of sick leave.

After this period, the sickness benefit shall be paid by the sickness insurer at the rate of 60 % of the last gross salary for 6 months. From the seventh month of incapacity for work, the amount of sickness benefit varies individually, taking into account the family situation of the incapacitated employee.

Any employee who fulfils all the conditions is entitled to receive sickness benefit:

- is registered with a Belgian health insurance company,

- has worked a minimum of 120 days in the 6 months prior to the incapacity for work,

- is recognised by a doctor as being unfit for work,

- has paid the minimum contributions to the health insurance fund.

In order to receive sickness benefit, you must inform your employer of your incapacity for work (by phone or e-mail) and provide the health insurance company with a sickness certificate issued by the attending doctor.

Unemployment benefit

Entitlement to unemployment benefit arises when the following conditions are met:

- 312 to 642 days of work over a period of between 21 and 42 months (the exact number of days of work depends on the age of the unemployment benefit claimant),

- registration with the competent employment office in Belgium,

- actively seeking work.

To apply for unemployment benefit you will need:

- identity documents or ID card, residence permit and work permit,

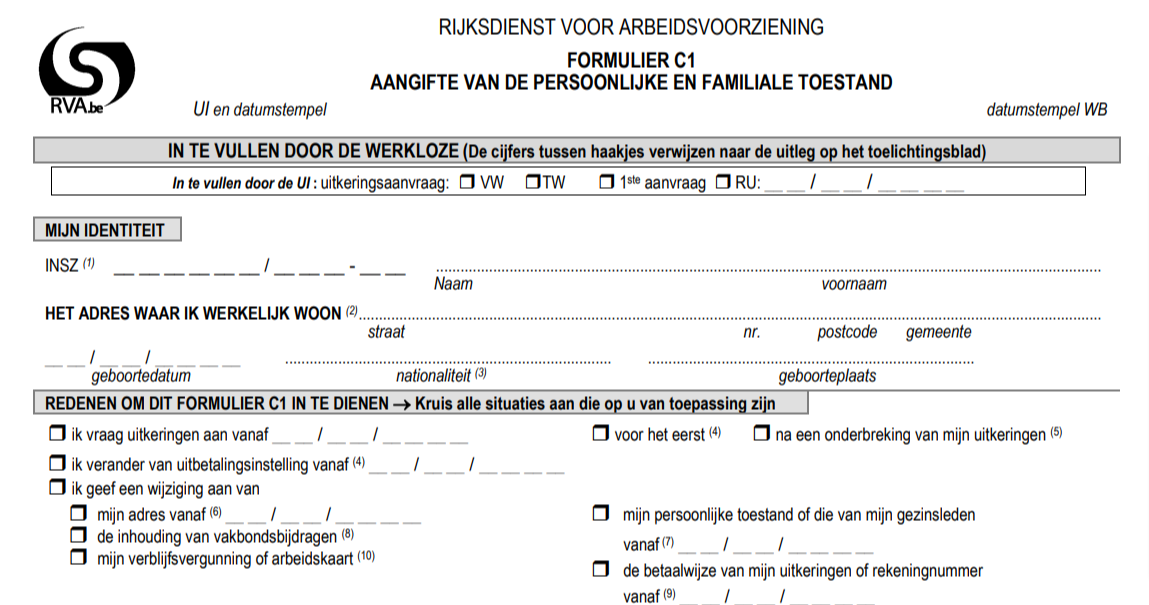

- C1 form, or a declaration of personal and family status,

- Form C4 or unemployment certificate - if you have left your job (issued by your employer),

- form C6 - if you were unable to work before claiming unemployment benefit (issued by the health insurance company),

- form C109 or personal unemployment statement - if you are claiming unemployment benefit after a period of inactivity, or if you are self-employed (form issued by Capac).

The application for unemployment benefit is submitted to the public social security institution Capac or the Caisse Auxiliaire de Paiement des Allocations de Chômage. The Capac processes the application received, sends it to the National Employment Office or the RVA and starts paying unemployment benefit. The benefit is paid at 65% of gross wages for the first three months and at 60% of gross wages for the next 9 months. Unemployment benefit is paid indefinitely, with the amount being adjusted or reduced after one year according to the recipient's marital status, income and length of service. The claimant is entitled to 3 months' benefit for each year worked.

If you plan to return to your home country from Belgium, you can apply for a transfer of the benefit to your home country 4 weeks after you have been registered as a jobseeker. The transfer of the benefit can be made using the U2 form, which will be issued to you on request by the competent employment office in Belgium.

Family benefits from Belgium

Are you working in Belgium and have children? Apply for Belgian child benefits.

Family allowances

The compulsory social insurance in Belgium, which you automatically acquire in the context of your employment, is decisive for entitlement to family benefits. Benefits are the responsibility of the individual Belgian regions. This means that the amount of the allowance and the related rules may vary depending on the region in which you live. Family allowances consist of a basic amount and an allowance supplement. The amount of the supplement depends on a number of family factors (family income, cohabitation, family composition, age of children).

Have you worked in Belgium? We will prepare your tax return and arrange your Belgian tax refund.

with a tax expert