I work in Austria. How do I file a tax return?

Do you find the Austrian tax system to be confusing and complicated? Should you file a tax return? How?

Throughout the year the austrian tax system takes so called tax advances which at the end of the tax year cumulate in the form of a tax return. You are entitled to a tax refund if your employer deducted a higher amount of tax from your paycheck than they should have.

Tax refund

A tax refund can be the result of:

- Working in austria for only a portion of the year.

- Working for multiple employers.

- Switching from one job to another during the year.

- Having work commute expenses.

- Financing a household or living both abroad and in Austria.

- Being married.

- Having children.

When to apply for a refund?

The austrian tax year lasts from 1st January to 31st December – the whole calendar year.

You can apply for a tax refund at the end of each tax year. You can file tax returns for up to 5 years back. For example in 2019 you could apply for the years 2014, 2015, 2016, 2017 and 2018.

To file or not to file a tax return in Austria?

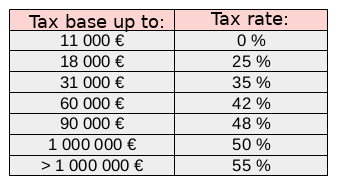

The income of austrian employees is taxed with a rate of 0% to 55%. The tax rate is determined based on gross income. Income up to 11 000 € is exempt from taxation so if your tax base is lower than that you are not required to file a tax return.

Here you can find the tax brackets:

Note:

_It is important to file a tax return in your home country if you worked in Austria for only a portion of the year. The austrian tax office will require the form L1 which your home country’s tax office will have to confirm based on the filed tax return._

Filing a tax return is mandatory if the taxpayer:

- Received a notice from the austrian tax office to file a tax return

- Had income that exceeded 11 000 € during the year

- Has a permanent or temporary residence in Austria (by definition a place where the taxpayer lived for more than 6 months / 183 days in a year)

- Has 2 or more jobs at the same time

- Receives Krankengeld

- Receives Insolvenzgeld

- Had income from selling real estate in Austria which he paid income tax for

Not having a Lohnzettel won’t do

In the austrian tax return your write financial information from a taxable income statement. This income statement is also called Lohnzettel in Austria, but you can also find it under L16. This document is issued by the employer before the end of the tax year: 31.12. You can also use payslips if your employer does not issue this document. A tax return in Austria can be filed both on paper and electronically.

When will I receive my tax refund?

The tax office declares 2 – 5 months for processing the request and transferring the money to your bank account.