How to fill out a Dutch Personal Income Statement (EEA)?

EEA is a document, that the Dutch tax office requests to declare your income which is not taxed in the Netherlands. This means, that you have to confirm if you did or did not have income in any other countries (such as in your home country).

This document has to be completely filled out and signed by the tax office in your country of residence. The Dutch tax office does not accept it if there are blank sections. Also, the tax office only accepts the original document (no copies, no scan, no pictures) and it reject EEAs if you make any corrections in ink.

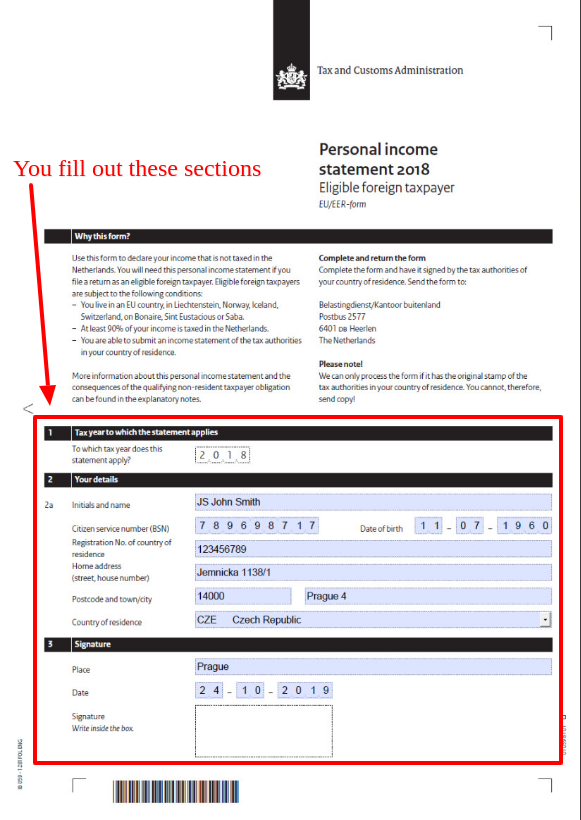

Now, what do YOU fill out?

- In section 2, the “Citizen service number’’ is the BSN/ Burgerservicenummer (the social services number in the Netherlands, which you can find in your Jaaropgave);

- The “Registration No. of country of residence’’ is, instead, your identification number in your country of residence.

Have a look at our EEA sample which shows how the form needs to look like in order to be approved by the tax office in the Netherlands.

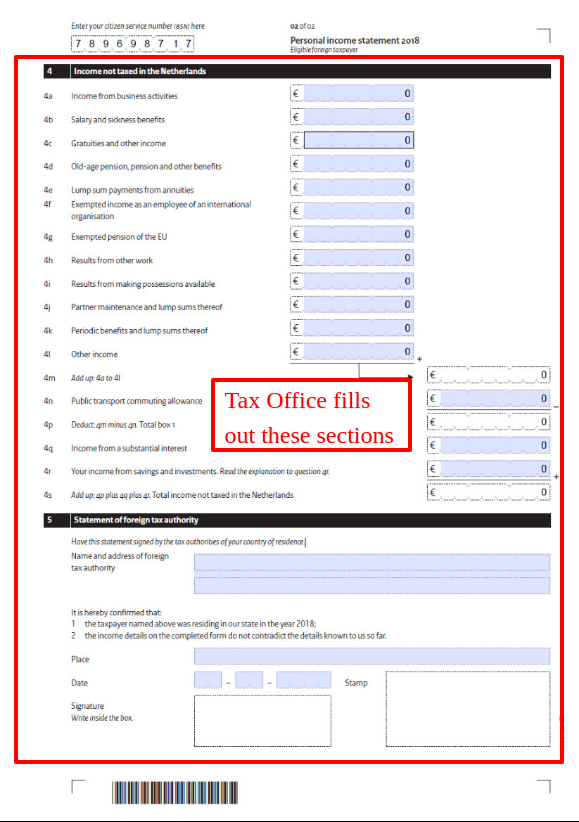

What does the Tax Office fills out?

Only the sections 4 and 5 need to be filled out, signed and stamped by the tax office in your country of residence.

You can download the Personal income statement off of our website: