IČO and DIČ (VAT ID) number - practical application

How is the VAT number and tax identification number used in reality? Here is an overview of the registers in which VAT and VAT are most commonly found.

What are IČO (IČ) and DIČ in the Czech Republic?

Since most countries keep their own names, codes or abbreviations for identification numbers, it is difficult to know which of them correspond with each other.

| Czech version | Meaning | Variants used abroad |

|---|---|---|

| DIČ | Daňové identifikační číslo / Tax identification number | VAT Identification number / VAT ID, VATIN - value added tax identification number, TIN - tax identification number |

| IČO /IČ | Identifikační číslo osoby / an abbreviation for the identification number of a natural or legal person in the Czech Republic | IN (Identification number/ CIN (Company identification number |

IČO number in practical use

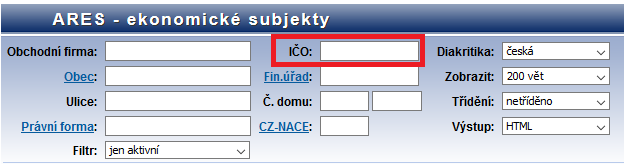

ARES application of the Ministry of Finance

The Administrative Register of Economic Entities, or Ares, is an information system of the Ministry of Finance whose main objective is to provide clear information on economic entities. Thus, Ares allows you to search for economic entities that are registered in the Czech Republic according to various characteristics. One of them is IČO - the identification number of a person.

In addition, the Ares application can also search for economic entities by:

- name - business name of the company,

- the name and surname - of the entrepreneur (self-employed/ OSVČ), the managing director or the statutory body,

- DIČ - Tax identification number.

The data in Ares is updated on a daily basis.

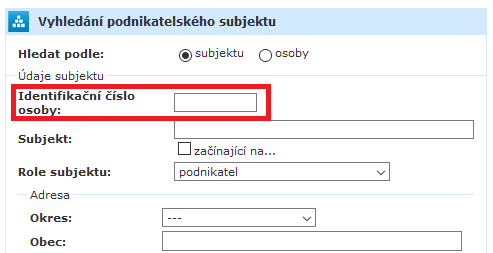

Trade Register of the Ministry of Industry and Trade of the Czech Republic

The Trade Register records data (and data changes) on business entities operating in the Czech Republic. These data are included, for example, the name and surname, identification number of the person, registered office, address, subject of business, address of the establishment or the period of validity of the trade licence. One of the criteria by which it is possible to search for an entity is the IČO - identification number of the person:

Business entities holding a trade licence can also be searched in the register by:

- name of the entity,

- the address at which it is based or operates a trade (when searching by address, it is necessary to fill in the municipality),

- the role of the entity, which may be of the following type:

- statutory body legal entity,

- or entrepreneur (self-employed/ OSVČ).

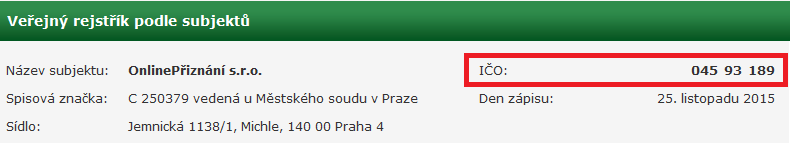

Public Commercial Register and the Collection of Deeds of the Ministry of Justice of the Czech Republic

The Public Register is an information system of public administration, which records data on entrepreneurs and commercial companies as provided by law. It is therefore a public list that is maintained in electronic form.

One of the criteria by which entities in the Public Register can be searched is the IČO - identification number of a person:

The registration number or business name is one of the main input criteria for finding information in the database as quickly as possible.

For each entity found, you can click on additional links containing an overview of the available information stored at the respective registration courts.

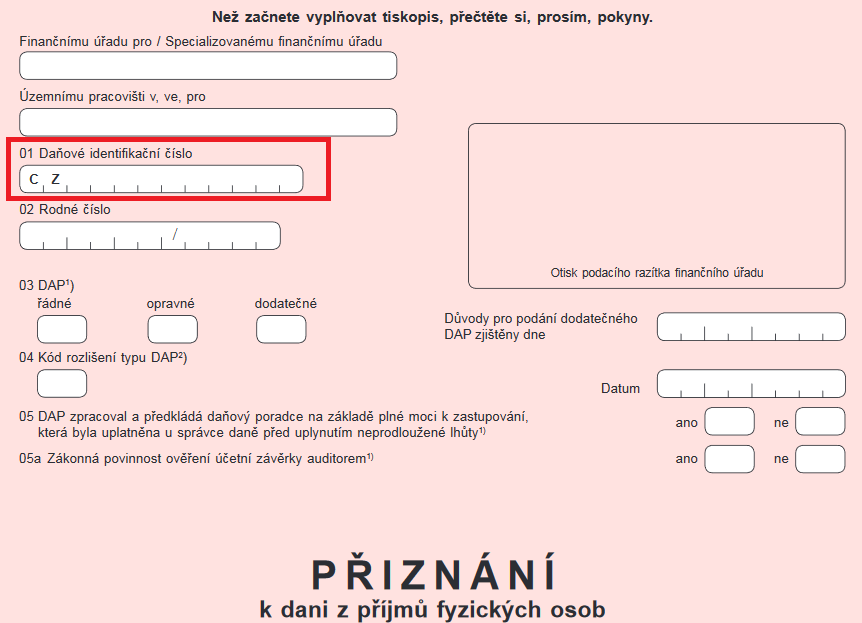

VAT number (DIČ) in practice

The tax identification number, or DIČ (TIN), is the identification number of each tax entity that is a taxpayer by law.

The VAT identification number is an important data or identifier that is indicated on tax documents, e.g. in.:

- tax returns,

- other submissions to the tax authorities,

- commercial documents (commercial contracts, invoices, orders, etc.).

DIČ / VAT identification number in tax returns:

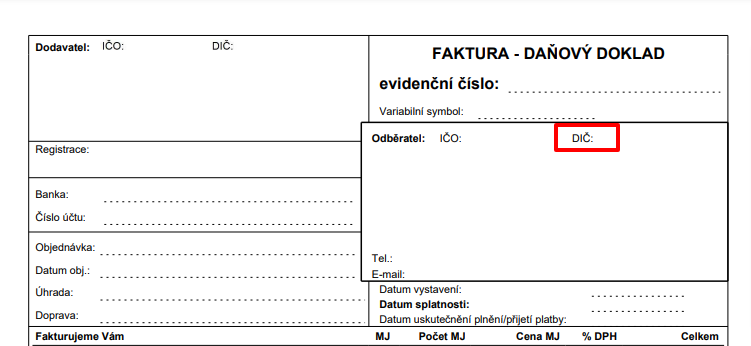

DIČ / VAT identification number in an invoice:

Be sure to read our blog regularly and you won't miss any important news.

Do you have any questions about your taxes or tax return in the Czech Republic?

.webp)