What is Potvrzení zahraničního daňového úřadu k přiznání k dani z příjmů?

Understanding the so-called Potvrzení pro rok can be harder than it seems. In this article, we answer the most frequently asked questions and compiled a guide on how to fill it in correctly.

What do I need Potvrzení zahraničního dańového úřadu for?

This form is used as a proof that 90% of your income is generated in Czechia, therefore you are entitled to receive tax allowance for having children or for being married. After filling it in (except for one of the sections), you will bring the form to the tax office in a country where the minority (max 10%) of your income comes from. In Czechia, you are entitled to child tax credit only if your children live in the same household as you. You can‘t take advantage of the marriage allowance if your spouse is earning over CZK 68 000.

Where can I get this form?

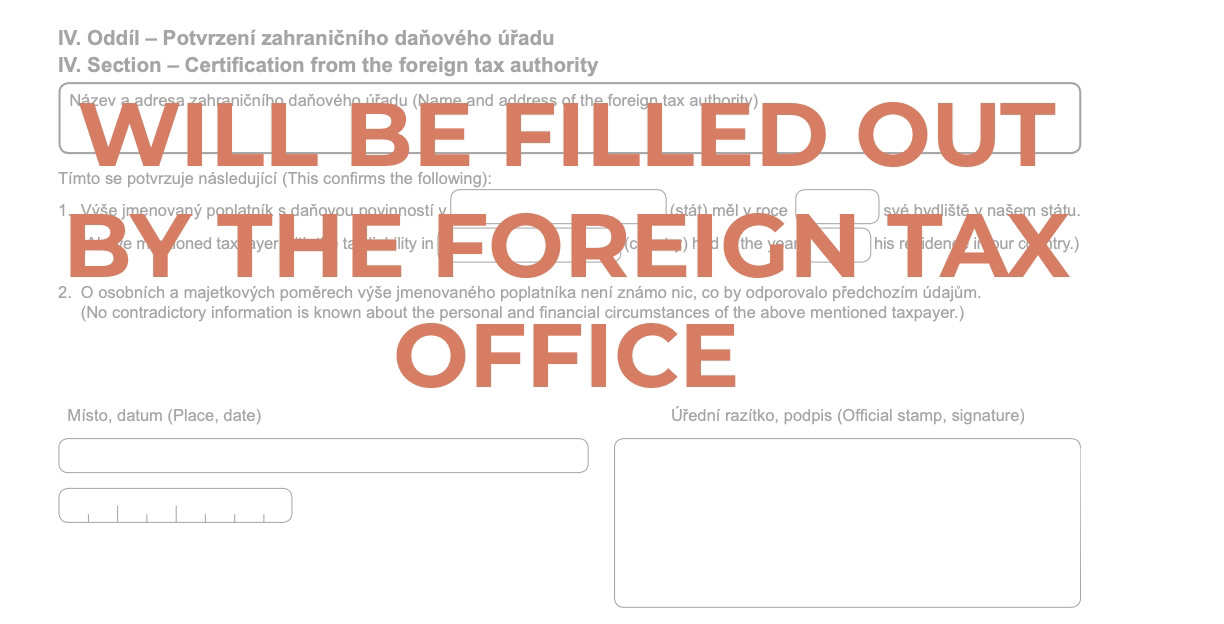

You have to obtain this form yourself from Finanční správa's website. The foreign tax office (tax office in the country from which the minority of your income is generated). The tax office will fill out the 4th section for you.

For example: Anna Kováčová is a Slovak living in Prague with her children. All of her income comes from her employment in Czechia. She wants to make use of the child tax allowance. She needs to prove at least 90% of her income comes from the Czech Republic. She fills out her personal information including her income and brings it to the Slovak tax office to validate the information.

How do I file this form correctly?

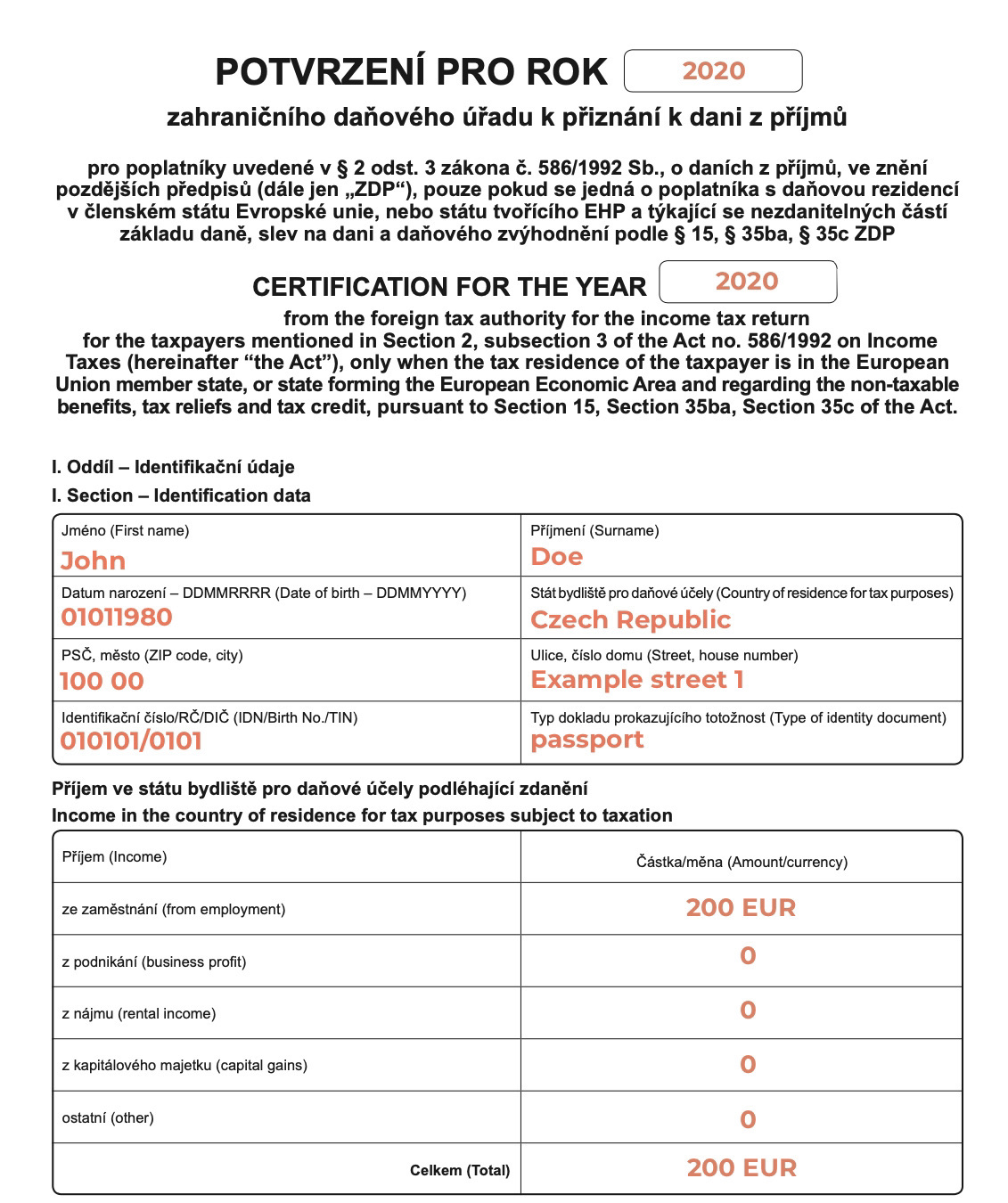

Take a look at your simple guide on how to correctly fill this form out.

Section I. – In this section you fill in your personal details like your income abroad and your address in the country in which you’re applying to get tax allowance in – Czechia.

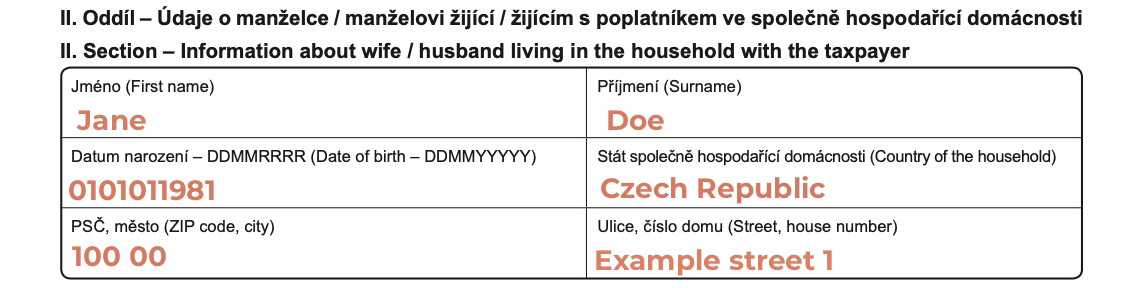

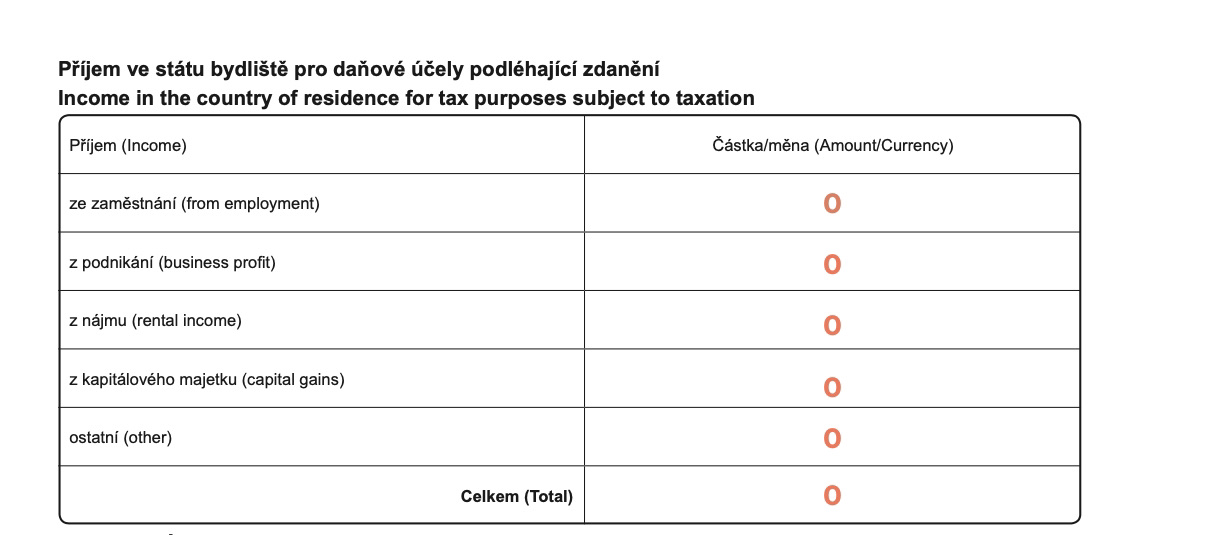

Section II. – Fill out your spouse’s personal information and their income generated abroad.

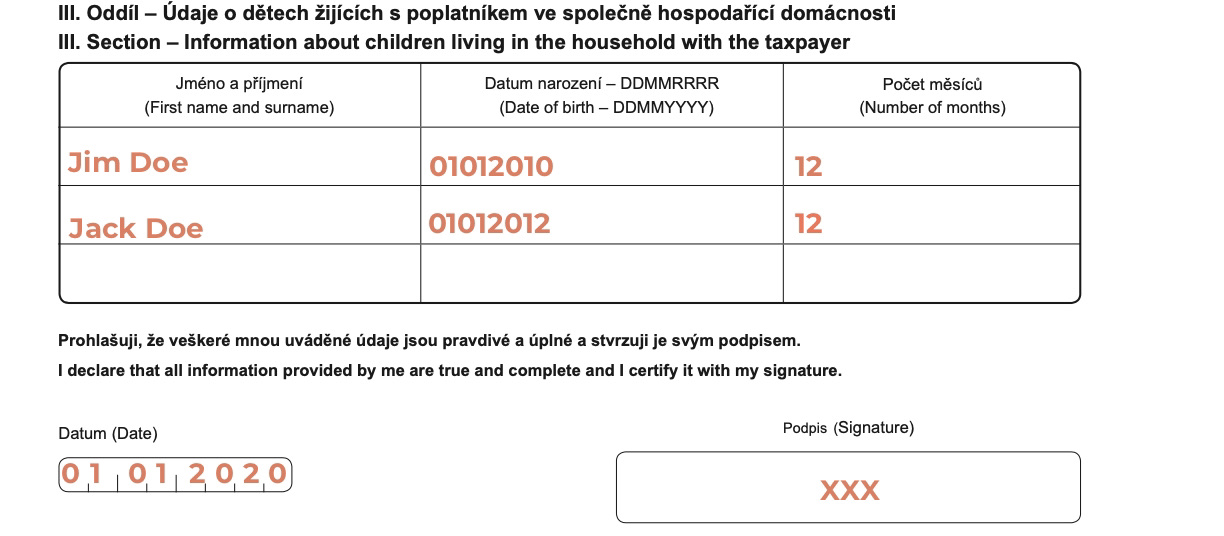

Section III. – Fill out personal information of your children and how many months out of the tax year you spent living together and declare that all of the information is true.

Section IV. – This section will be filled out and signed by the tax office.