Didn't find what you were looking for?

Leave us your number and we will call you.

Are you a non-resident working in Slovakia? Did you find out you own money on tax through filing a tax return? To which bank account should you send the money to?

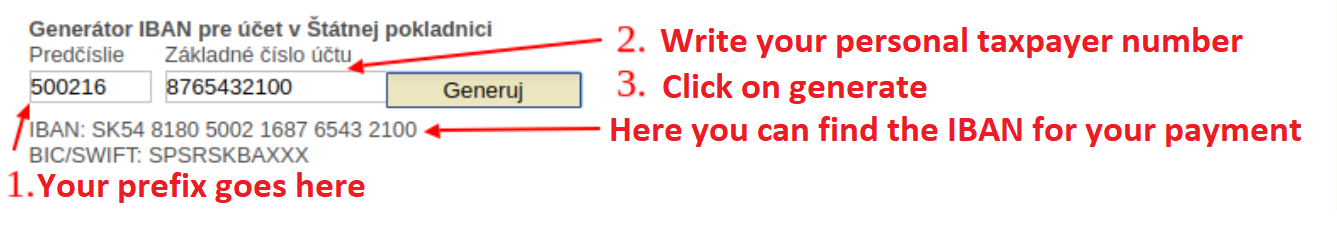

The tax office does not offer one universal bank account which you could send your money to. Your correct bank account number consists of a 6-digit prefix and a 10-digit account number, a so called OÚD. This is followed by a slash and the code of the National treasury. The prefix is determined by the type of tax you are paying. For example if you are paying individual income tax based on a type A or type B non-resident tax return with income in Slovakia, you select the prefix 500216.

Each taxpayer has an assigned account number – osobné číslo daňovníka (OÚD) which translates to personal taxpayer number. You can apply for this number directly in the form of an online generator on the tax office site. You simply input your personal identification number (rodné číslo) or VAT number (DIČ), write the verification code and press search.

We have asked the financial directorate in Banska Bystrica how to pay if the generator does not generate the personal taxpayer number from the assigned VAT number or personal identification number. If the generator doesn’t find your personal taxpayer number after filling in the necessary information one will be sent via post to your address. Use the variable symbol 1700992019 during payment. This means that you cannot generate an IBAN and pay the tax debt until the tax office finishes processing your tax return and sends the letter with the assigned personal taxpayer number.

In this case the delay has been caused by the tax office. A taxpayer who filed on time but is unable to pay a debt due to the processing delay can pay after the deadline without any additional penalties.

After a personal taxpayer number has been assigned you will have to create the IBAN. For a simpler solution you can use the IBAN generator for your national treasury account. Put in the prefix for your non-resident individual income tax - 500216 and your personal taxpayer number and the generator will display a ready IBAN for your tax payments.

The variable symbole for all tax payments is the same for all: 1700992019.